Getting a salary raise is exciting — it’s a reward for your hard work and often feels like an invitation to upgrade your lifestyle. But if you’re not careful, those extra pounds can disappear just as quickly as they arrived. This common trap is called lifestyle inflation — when your spending increases in proportion to your income, leaving your financial situation no better than before. The key to long-term wealth isn’t just earning more, but managing more wisely. Here’s how to avoid lifestyle inflation and make your raises truly count.

1. Understand What Lifestyle Inflation Is

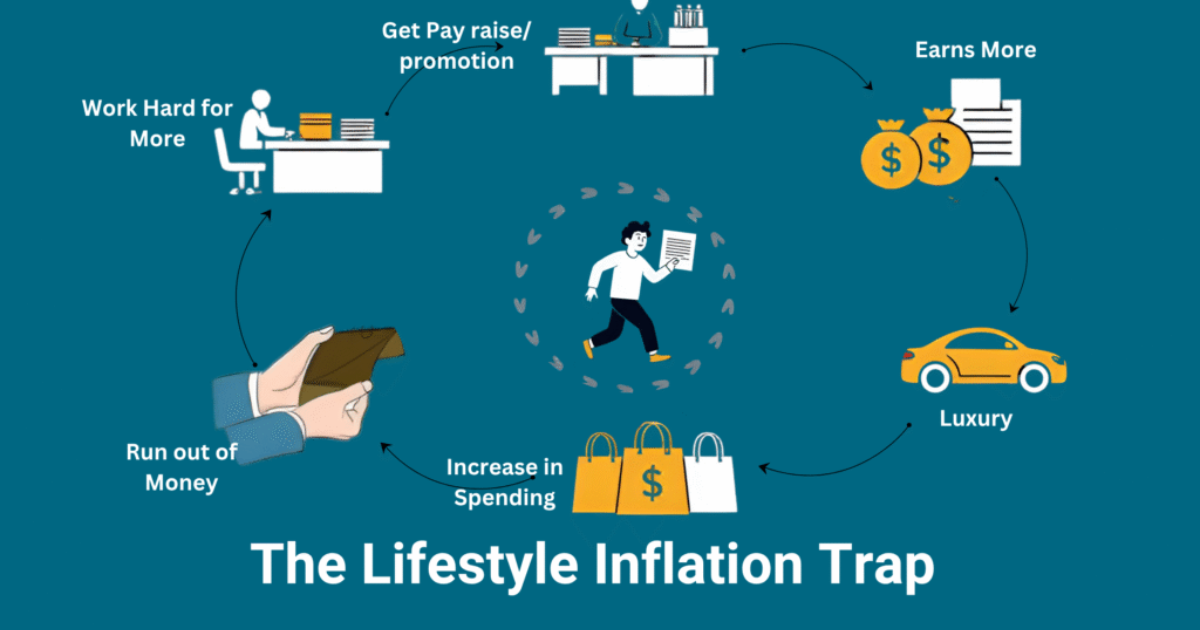

Lifestyle inflation happens when higher income leads to higher expenses — better cars, fancier restaurants, larger homes, or frequent holidays. While occasional rewards are fine, consistent upgrades can prevent you from building savings or achieving financial freedom.

Recognizing lifestyle inflation early helps you make intentional choices. The goal isn’t to deny yourself pleasures but to grow your financial stability along with your income.

2. Pretend the Raise Never Happened (At First)

One of the most effective strategies is to automate your savings before you even feel the raise. For example, if your salary increases by £500 a month, set up a standing order to move at least £300 of that straight into your savings or investment account.

This way, you adjust to your new income without changing your day-to-day spending habits. You’ll still enjoy a little extra money for small upgrades while your financial security grows in the background.

3. Set Clear Financial Goals

A salary increase is the perfect time to revisit your financial goals. Do you want to build an emergency fund, pay off debt, save for a house, or invest for retirement?

Having a specific purpose for your extra income keeps you motivated and disciplined. When your money has direction, you’re less likely to waste it on impulse purchases or fleeting luxuries.

4. Upgrade Mindfully — Not Automatically

It’s natural to want a few lifestyle improvements after a raise, but make them intentional and limited. Instead of upgrading everything — car, phone, wardrobe, and holidays — choose one or two meaningful changes that genuinely improve your quality of life.

For instance, spending a bit more on healthier food or a gym membership might have lasting benefits. The key is to ensure every upgrade adds value, not just status.

5. Track Your Spending

Keeping track of where your money goes is essential to spotting creeping lifestyle inflation. Use a budgeting app or spreadsheet to categorize expenses and monitor trends.

If you notice your entertainment or dining budget doubling since your raise, it’s a sign to reassess. Awareness is your first line of defense against unconscious overspending.

6. Keep Living Below Your Means

Even after a raise, maintaining a modest lifestyle can dramatically boost your financial future. Living below your means doesn’t mean living poorly — it means living strategically.

When you consistently spend less than you earn, you create room to invest, save, and prepare for unexpected expenses. Over time, this habit can make you far wealthier than someone who earns more but spends everything.

7. Reward Yourself — Within Reason

Completely denying yourself enjoyment can lead to burnout or resentment. It’s okay to celebrate your success — just set boundaries. Allocate a small portion of your raise (say, 10–15%) for fun or indulgences.

For example, treat yourself to a weekend getaway or upgrade one item you use daily. When done consciously, these rewards reinforce good habits without derailing your financial progress.

8. Keep Expanding Your Financial Knowledge

Understanding how money works helps you make smarter decisions. Use your raise as motivation to learn about investing, saving strategies, and personal finance planning.

Consider speaking to a financial advisor or reading about long-term wealth building. The more you know, the less likely you are to let emotional or impulsive spending decisions take over.

9. Surround Yourself with Financially Responsible People

Peer influence plays a big role in how we spend. If your circle constantly indulges in expensive habits, it can be hard to resist keeping up. Instead, spend time with people who value saving, investing, and financial independence.

Conversations about smart money management can keep you inspired to make better choices after a raise.

10. Remember the Bigger Picture

Every raise can bring you closer to your financial dreams — if you manage it wisely. Whether it’s buying a home, retiring early, or traveling the world, controlling lifestyle inflation ensures your hard work translates into real progress.

The next time you get a pay bump, don’t ask, “What can I buy now?” — ask, “How can this raise bring me closer to freedom?”

Conclusion

Avoiding lifestyle inflation is about mindful money management and long-term vision. By automating savings, setting goals, and upgrading intentionally, you can enjoy your success today while securing your financial future. Remember — wealth isn’t built from how much you earn, but from how much you keep and grow.